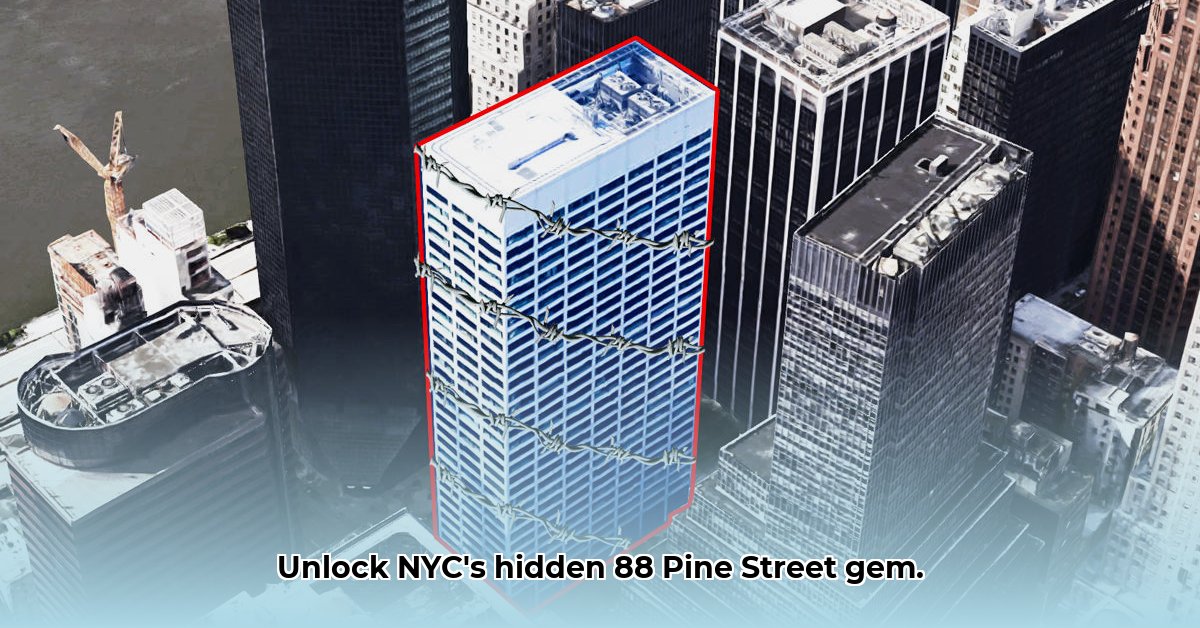

88 Pine Street: A Cautious Approach to Investment

Thinking about investing in 88 Pine Street, a 32-story building in New York City's Financial District? This guide provides a structured approach to due diligence and investment strategy, acknowledging the limited publicly available information. While the building's prime location is attractive, a thorough investigation is crucial before committing capital.

Location and Initial Assessment

88 Pine Street's location, steps from Wall Street and Pier 11, offers significant advantages. Proximity to major transportation hubs and a high concentration of businesses suggests potential for tenant demand. However, location alone doesn't guarantee investment success. The scarcity of readily available data online necessitates a more comprehensive investigation than usual. This lack of information represents a significant risk that must be carefully addressed.

Due Diligence: A Step-by-Step Guide

Investing in 88 Pine Street requires painstaking due diligence. The following steps will help you assess the opportunity:

Market Research: Analyze comparable buildings in the Financial District. Determine current rental rates, vacancy rates, and competitor analysis to understand the market landscape. This crucial step provides a baseline for evaluating 88 Pine Street's potential.

Physical Inspection: A comprehensive in-person inspection is essential. Assess the building's condition, amenities, and overall appeal. Identify any potential maintenance issues or areas requiring upgrades. This is critical for understanding the realistic costs associated with property ownership.

Financial Projections: Develop realistic financial projections. Given limited public data, consult a financial professional experienced in NYC commercial real estate. Assume a range to account for uncertainties in income and expenses. Don't underestimate the importance of a realistic financial model.

Legal and Regulatory Compliance: Research zoning laws, building codes, and environmental regulations to ensure compliance. Consult with legal counsel specializing in NYC real estate transactions. This step avoids potentially costly surprises.

Expert Consultation: Engage local real estate professionals with deep knowledge of the Financial District. Their expertise offers invaluable insights into market trends and potential challenges. Your local network enhances success.

Risk Assessment: Potential Challenges

Investing in real estate inherently involves risk. Consider these potential challenges for 88 Pine Street:

| Risk Category | Likelihood | Potential Impact | Mitigation Strategies |

|---|---|---|---|

| Information Scarcity | High | Significant | Extensive due diligence, expert consultation, alternative data sources |

| Market Volatility | Medium | Moderate | Diversified portfolio, close market monitoring |

| Unforeseen Repairs | Medium | Moderate | Thorough inspection, contingency planning |

| Regulatory Changes | Low | Moderate | Continuous regulatory updates, legal counsel |

Long-Term Investment Strategies

A long-term perspective is crucial for maximizing returns on 88 Pine Street. Consider these strategies:

Value Enhancement: Identify opportunities for renovations or updates to increase rental income and property value. Modernization can significantly improve tenant appeal.

Strategic Leasing: Aim for long-term leases with reliable tenants to ensure stable income streams and minimize vacancy rates. Secure long-term agreements to minimize risk.

Market Monitoring: Continuous monitoring of market conditions is essential for adapting to changes and maximizing investment returns. Stay informed on market trends and adjust your approach.

Conclusion: A Calculated Investment

Investing in 88 Pine Street presents a calculated gamble with potential for significant rewards. The lack of readily available information emphasizes a detailed, cautious approach. Thorough due diligence, strategic planning, and prudent risk management are key to successful investment. Remember, your due diligence is your best investment.